VALUATION ADJUSTMENT / VALUE SURCHARGE CLAUSES (ALSO: VALUE INCREASE CLAUSES)

Adjustment clauses in industrial property insurance help to adjust the sums insured annually – and always for the new insurance period.

Usually, the sums insured are calculated on the basis of the respective new value of the machinery and equipment. Changes to the inventory, additions and disposals and, of course, price developments mean that the insured value fluctuates constantly. To ensure that price changes in the new values do not lead to underinsurance or overinsurance, the policyholder must constantly adjust his sum insured to the current development.

With value adjustment clauses, the adjustment of the sum insured can be calculated year by year without having to carry out an individual assessment each time.

And it works like this:

Based on the current new values, a basic sum is calculated for the items to be insured. The basic sum is based on prices from 1970, 1980, 2010 or 2015 (this is usually determined by the insurance companies).

The value supplement is calculated using index figures from the Federal Statistical Office. The sum insured is therefore the basic sum plus the value supplement.

If a value adjustment clause is agreed, the insurance company is liable for a maximum of the basic sum plus twice the value supplement in the event of a claim.

The prerequisite for this is that both the basic sum and the simple value supplement have been assessed by an expert.

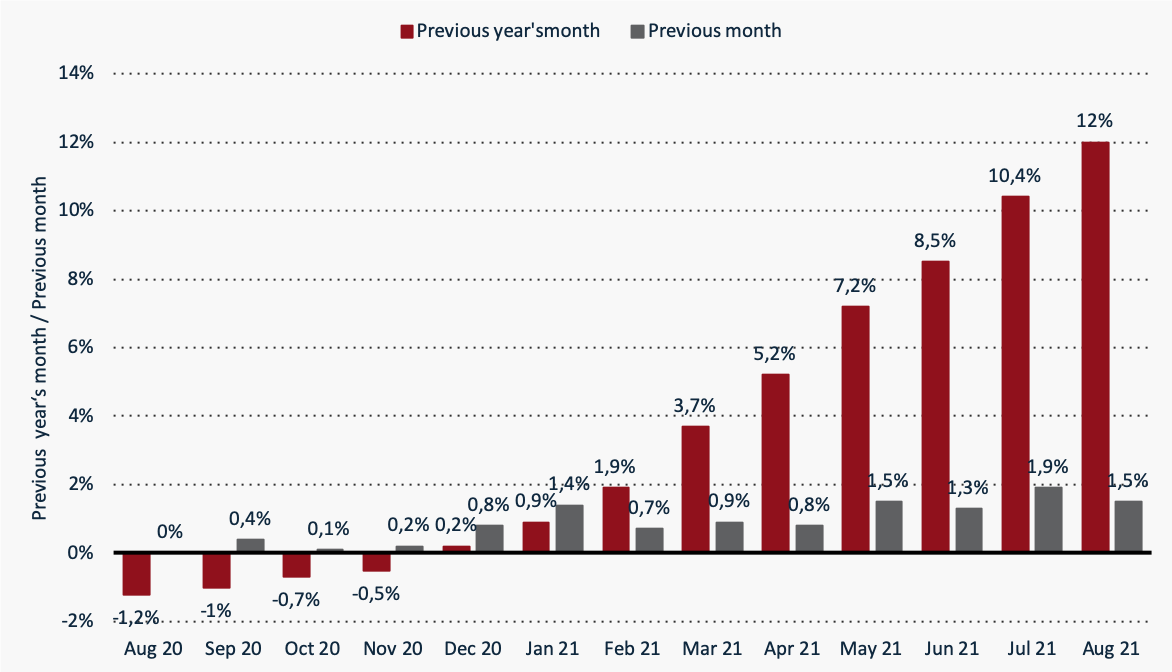

The additional value clauses therefore also protect to a certain extent against inflationary price developments during the year.

THE CORRECT CALCULATION OF THE VALUE ADJUSTMENT

In order to determine the value surcharges, the price tables of the Federal Statistical Office, Fachserie 17 Reihe 2, are usually used. For these values, about 6,300 companies are asked about the current prices of about 1,350 types of goods.

From these, the price increases of individual commercial goods – from low-fat curd cheese to articulated lorries – are determined.

However, these price data and their rates of increase always refer to the ready-to-deliver product ex works. This means that these indices do not include freight, packaging and assembly and their price increases. This can lead to considerable inaccuracies, because the assembly costs often develop in a significantly different way in terms of price than the pure manufacturing costs of a machine. The correct application of the specific designated price table 610 of the FSO for repair, maintenance and installation is complicated and is therefore mostly omitted.

There are separate price series for plants and equipment insured for electronics, as a distinction is made here between electronics and technology.

In addition, some insurance companies work with their own industry indices. Therefore, in order to determine the sum insured by means of value surcharges, the price indices must be applied correctly.

The more incorrectly the value supplements have been determined, the more volatile the price fluctuations are and the longer ago the last expert appraisal was, the sooner the sum insured for the next insurance year should be determined by a new appraisal.

9. Check when your sum insured was last determined by an expert.

10. Call us (tel. +49 40 602 13 33).