Why asset accounting is not a reliable tool for determining insurance values

20th March 2023 by P. Merker

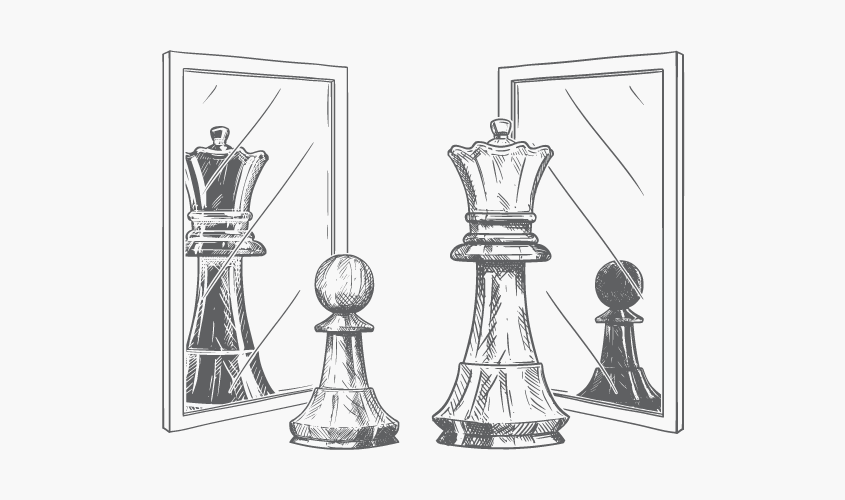

Many companies adopt the values from asset accouting one-to-one for the company’s property insurance. However, the fixed asset summary is not an insurance summary. Both instruments serve different operational purposes.

It is therefore not surprising that the unchecked transfer of asset accounting leads to incorrect insurance sums. The consequences are underinsurance or excessively high insurance premiums.

Careful! Many insurers restrict an underinsurance waiver if the insured value is determined solely on the basis of the asset accounting, namely on the items recorded there.

We would like to show where the pitfalls lie and how to do it better.