5 + 1 way your machines will help you get funding

27th November 2022 by P. Merker

Managing investments, securing liquidity – even in “normal” times, it is a challenge for every entrepreneur to solidly finance his current expenses and machinery.

Even though one may wonder when there have ever been “normal” times, many additional hurdles are piling up right now in front of the medium-sized company that wants to keep its finances in order.

Inflation is driving up prices and unsettling buyers and customers, interest rates are rising, and future energy costs are almost impossible to calculate. Even for companies that can easily pass on increased costs, liquidity is getting tighter. This is due, for example, to the fact that sales tax – which has to be financed in advance – is rising along with prices. And banks are being more stingy than ever with credit lines – instead of expanding them, they are more likely to cut them.

Currently, 24.3 percent of businesses currently negotiating their credit needs report significant reluctance on the part of banks – the highest figure since 2017, according to a survey by the Munich-based Ifo Institute.

Lack of or insufficient collateral is often one of the biggest obstacles to credit:

In a business survey conducted by the DIHK in the summer of 2021, for example, one-fifth of medium-sized companies (20-199 employees) said that collateral was the biggest challenge in obtaining debt financing.

Many of our customers confirm this: the banker waves off the idea or raises his hands helplessly when the machinery is offered as collateral. In many cases, this is simply because the banks lack the know-how and the intellectual access to the equipment. As grandfather used to say: “Wat de Buer nich kennt, dat frett he nich …” (What the farmer doesn’t know, he won’t eat).

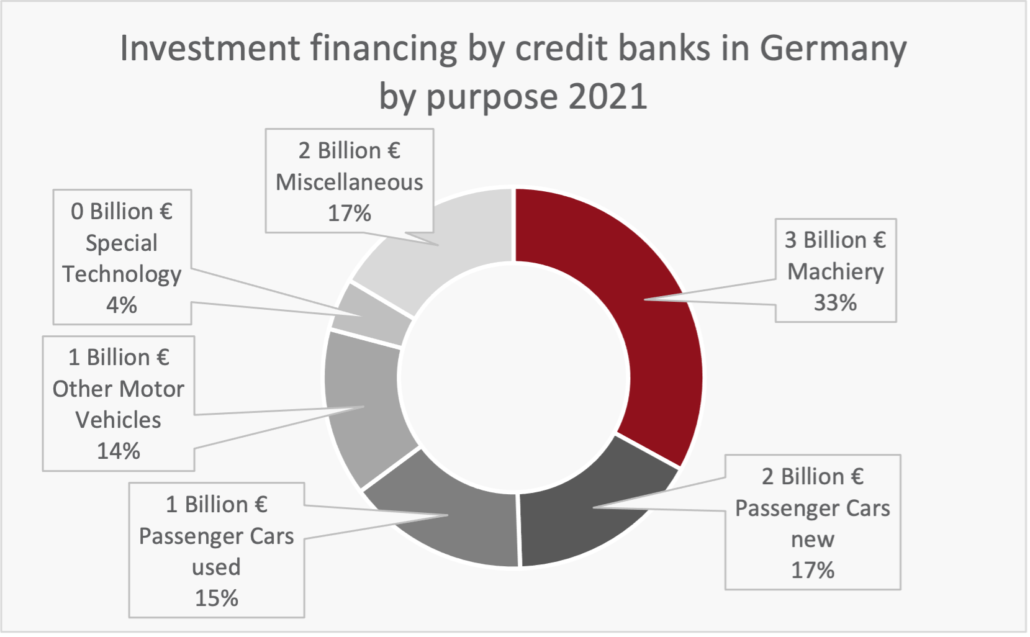

This is all the more astonishing given that machinery financing still accounts for the lion’s share of investment financing.