3. Asset Deal or Share Deal? Which is preferable?

Whether a company purchase should be carried out as an asset deal or a share deal always depends on the individual case. The decision criteria are manifold and concern tax considerations, practical and legal considerations or liability issues.

We give a few examples:

Is it always possible to choose between an asset deal and a share deal?

- If you are buying a sole proprietorship, for example, a share deal is out of the question because there are simply no “shares”. A sole proprietorship has no legal personality of its own and therefore no company shares.

- If you buy shares in partnerships, the tax consequences are the same as in an asset deal, while under civil law the shares are transferred as in a share deal.

- If, on the other hand, you are planning a hostile takeover, you will certainly not want to approach your “target” (i.e. your target company) about selling its assets. An asset deal is most likely not possible.

- Even in the case of insolvency, a share deal may be possible but rarely makes sense. Rather, it is a matter of separating out the assets of value.

How high is the tax?

Asset deals and share deals have very different tax consequences. These depend not only on the structure chosen, but also on which side you are on (buyer or seller) and the very individual circumstances of the parties involved.

In terms of buyer-seller, it is usually a case of “one man’s joy is another man’s sorrow.”

Here are some aspects to consider:

- As a buyer in an asset deal, you can depreciate the depreciable fixed assets – i.e. the buildings, machinery, equipment, vehicles, but also intangible assets – based on the current market values (a so-called “step-up“). This possibility does not exist when acquiring a share in a company. We will return to this in detail

- For the seller of a corporation who chooses the asset deal, the problem arises that the transfer of the purchase price from the “empty” shell of the company entails higher tax payments (trade tax, corporate income tax, final withholding tax) than if he were to sell, say, GmbH shares.

- The situation is different, however, if losses are carried forward.

- If real estate is included in the basket, the asset deal leads to real estate transfer tax liability, while the share deal opens up structuring possibilities.

In fact, there are countless metres of literature on the subject and many outstanding experts invest a lot of work in optimising their clients’ transactions accordingly. The best among them even think about structures that are advantageous for a later sale already when buying a company!

Is it possible to ensure that all the assets that are to go with the asset deal really go with it?

The so-called principle of certainty applies: only those assets that are sufficiently specifically defined in the purchase agreement will be sold. If something has been “forgotten”, you have to renegotiate – and that can be expensive.

Contracts with third parties that are to be taken over are also a factor of uncertainty. For this to succeed, the third parties must agree.

An exception to this are employment contracts, which are “automatically” transferred under certain conditions. Here, too, it should be thoroughly checked in advance whether this is what is wanted.

And how can we ensure that there is no rotten apple in the basket in the share deal?

For example, unidentified liabilities and inherited burdens can lead to liability risks for the buyer.

It also happens that contractual partners of the company for sale have reserved extraordinary rights of termination should the shareholder change. This may leave you without your most important business partner.

You may now have a small impression of how complex the decision for a transaction structure can be.

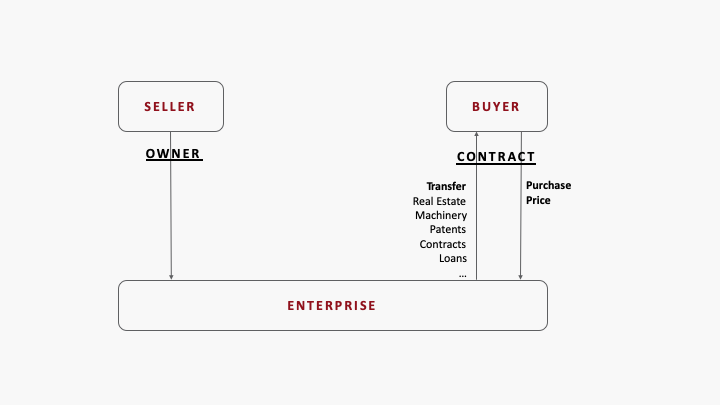

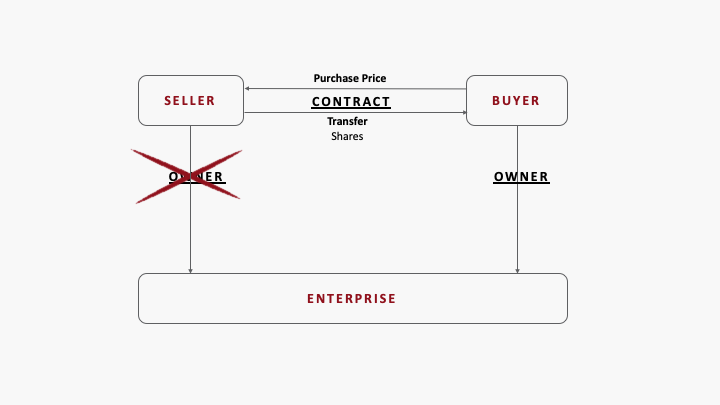

In the following, let us assume that you as a buyer have already gone through this process and that a decision has been made in favour of an asset deal.

We had identified the possibility of a step-up as an important motive for the asset deal.

To recap:

A step-up means that the acquired (depreciable) assets are revalued and depreciated on the basis of this revaluation. If the fair values are higher than the current book values, this results in additional depreciation potential. Additional depreciation potential also arises from the possibility to write off the goodwill remaining after the revaluation of the assets.

These possibilities do not open up in the case of a share deal. Here, the old depreciation plans are simply continued within the acquired company.

The interesting question is how exactly the revaluation of the assets is carried out and how the purchase price is allocated to the individual assets. For here, too, there are further structuring possibilities that can lead to higher or lower tax payments.

Since this is the part we very often have to deal with in our valuation practice, let’s take a closer look.