How to correctly apply and determine replacement values

26th of July 2022 by P. Merker

What is it about?

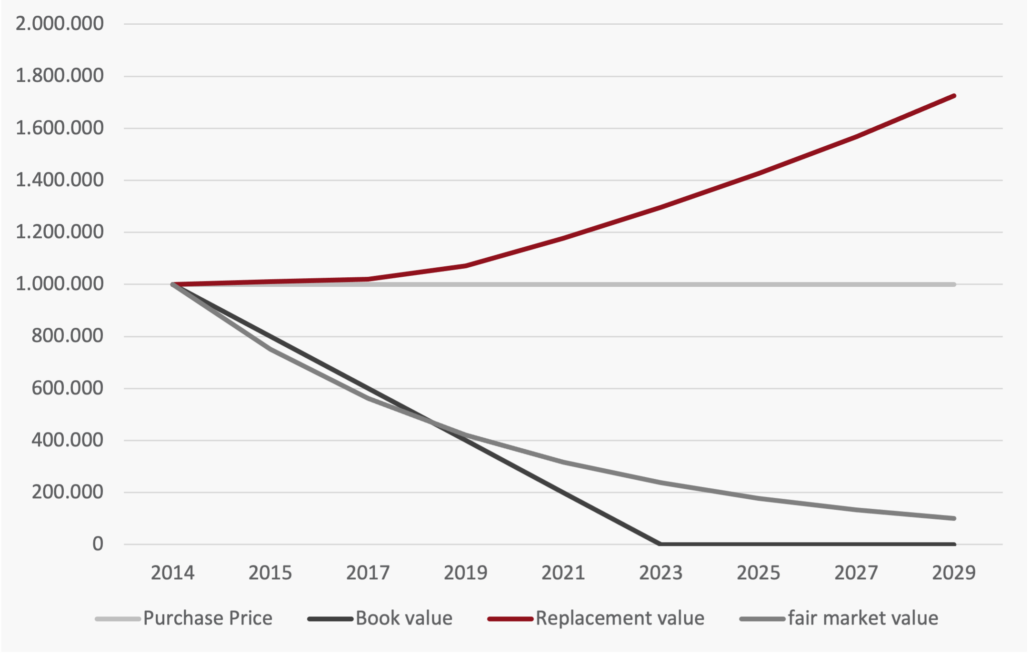

The replacement value is – in our opinion – one of the most interesting terms in valuation practice.

The crux is that – depending on the economic context – replacement values can be quite different.

Since it is generally always a good idea to clarify exactly what we are talking about (and in particular, of course, when preparing a valuation report), we would like to introduce the three most important concepts below.

These are

- the current value, as you know it from motor vehicle insurance

- the replacement cost, as used in business management

- the replacement value as used in business property insurance

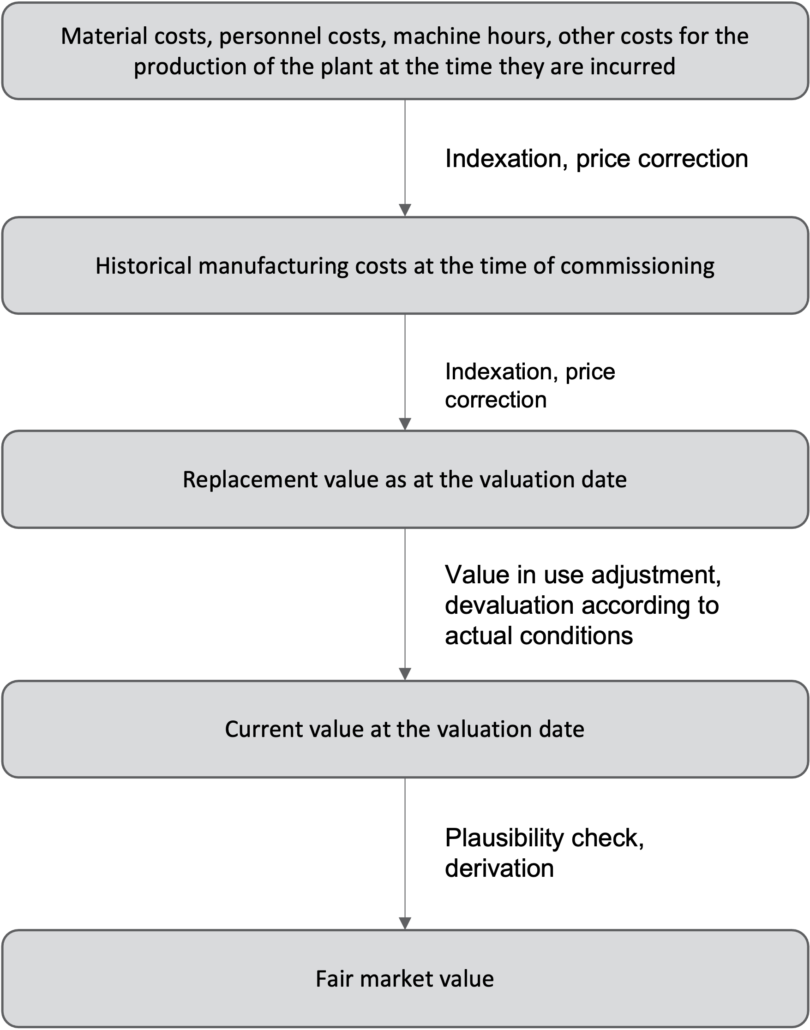

Furthermore, in our valuation practice we calculate current values and replacement values as a basis for determining fair market values, namely

- to check the plausibility of comparative values and

- if no comparative values exist, for example in the case of self-constructed machinery and equipment.

If you are interested in how we proceed with machinery valuation, we recommend our article “How to value machinery”.