WHAT YOU WILL MISS IF YOU DO NOT DETERMINE A NET ASSET VALUE WHEN VALUING YOUR COMPANY

10th August 2021 by P. Merker

Almost every entrepreneur will have to deal with the topic of business valuation and due diligence at some point in his or her entrepreneurial life. Typical occasions are for example

- Growth through acquisitions

- Raising capital through an IPO

- Succession solutions through sales

- Deinvestment strategies

Before each of these transactions, there is usually a valuation of the company to be bought or sold (or floated on the stock exchange) and – in the case of a purchase – the “acid test”.

A good company valuation is the basis for price negotiations (because, of course, the determined company value is not automatically the purchase price). In addition, a good company valuation also shows what risks are associated with the acquisition of a company.

The in-depth risk analysis – the “acid test”, so to speak – is also part of due diligence. The risks identified and assessed also influence the purchase price.

Ideally, business valuation and due diligence are closely interlinked, so that the findings from the business valuation flow into the due diligence and vice versa.

There are various ways to value a company. Which one or which ones are chosen depends on the objective and the available resources.

Each valuation method has a specific angle or linking point. However, you will gain the most insights if you (or your assessment expert) apply all three methods and put them in relation to each other.

This results in – and this is what this is all about – risk-relevant insights that might otherwise remain hidden from you.

I. WHAT METHODS ARE THERE FOR EVALUATING A COMPANY?

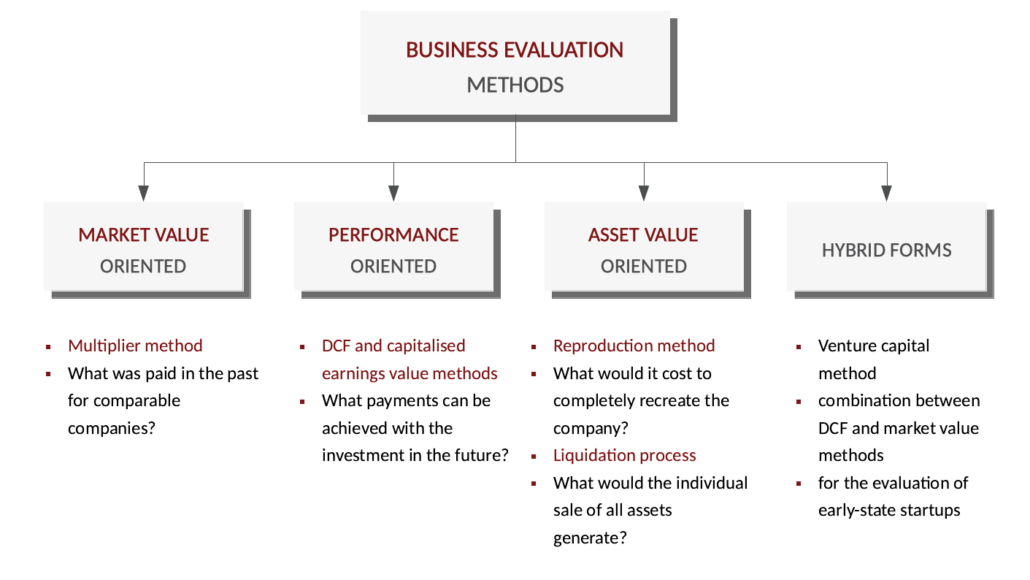

There are three main methods. Each method of business valuation has a specific perspective or point of contact.

- Market value-oriented methods: The starting point is the market

- Performance-oriented methods: The starting point is the future success of the company.

- Asset value-oriented methods: The starting point is the asset values of the assets.

Business Evaluation Methods

Market value based methods

In market-based valuations, the focus is on the price at which similar companies are currently trading on the market. In this case, the valuation is carried out using multiples. The respective multiplier is then multiplied by the sales, EBIT or EBITDA of the company to be valued.

Example: EUR 5 million sales p.a. x 1.3 (multiplier) = EUR 6.5 million enterprise value

The exciting question is where the appropriate multiples come from.

These are obtained by looking at real company transactions – from comparable companies in the same industry – and then calculating backwards:

Example: The company was sold for EUR 7.3 million with sales of EUR 6 million. Therefore: EUR 7.3 million / EUR 6 million sales = 1.22 (multiplier)

You rarely have to make the effort yourself, because there are data collections available, for example, from banks, chambers of commerce and M&A consultants.

The company valuation with multiples is often used to estimate the results of the other methods.

In addition, the method is often used in valuation practice for the valuation of medium-sized companies.

Performance / Net present value-oriented methods

The idea behind these methods is to value a company on the basis of future profits or surpluses. After all, that is what it is all about.

Both the capitalised earnings method, which is widely used in Germany, and the discounted cash flow (DCF) method, which originates from Anglo-Saxon valuation practice, fall into this category.

These methods are referred to as capital value-oriented or income value-oriented, since the company purchase is viewed like an investment on the capital market and the future cash flows or profits are viewed more or less like their interest or dividends. Methodically, the future profits or payments are discounted to today.

The big challenge here is to forecast the future payments and profits (which is all the more difficult the further in the future they lie) and to determine the discount factor. Ultimately, all the risks and rewards are condensed into the discount factor. It is the great expertise of the valuer to determine and weight these.

Incidentally, you can also recognize a good valuer by the fact that he or she does not simply extrapolate values from the past, but models the future plausibly using well-founded assumptions.

The difference between the capitalised earnings method and the DCF method

A fundamental difference between the capitalised earnings value method and the DCF method is as follows: The capitalised earnings value method uses future profits or successes (i.e. accounting figures), while the DCF method is based on cash flows.

Large, international companies are valued using net present value methods. In addition, the method is now regarded as the standard in business valuation practice, because it is not ownership that is the goal of entrepreneurship, but what comes out of it year after year (usually).

Substance value-oriented methods

The idea behind the net asset value is impressively simple: A company is worth as much as its machinery, real estate, tools, financial assets, inventories – in other words, its substance – put together. The debts are deducted and voilá – the company value stands.

Depending on the perspective from which the company value is of interest – that of a buyer or a seller – there are two different approaches to determining the substance values.

Reproduction value

A buyer would determine the net asset values by asking himself what it would cost him to buy the real estate, machines, inventories, etc. on the market. This is how the so-called reproduction value is obtained. The method used here is called the reproduction method. It answers the question of how much one has to spend to completely reproduce the company.

Liquidation value

A seller, on the other hand, would ask what he would receive if he sold all assets, goods, inventories, etc. This is the so-called liquidation value. The procedure is called the liquidation value procedure.

Application of the net asset value method – 3 cardinal errors

The big challenge in applying the net asset value method is identifying all assets and determining the correct net asset values.

A first major error would be to use only the assets on the balance sheet. In this case, values such as a customer base or a strong own brand would remain without valuation. However, such assets undoubtedly have a tradable value.

A second mistake is made if the identified assets are then recognized in the valuation at their accounting values – possibly somehow “up-indexed”. Every merchant knows that accounting valuations rarely match reality.

While goods, inventories, raw materials or even financial assets such as shares can usually be valued relatively easily on the basis of existing markets and stock exchanges, real estate, machinery and vehicle fleets are often the “great unknowns” in the accounts. It is not without reason that the terms “hidden reserves” or even “hidden charges” (are said to actually exist!) have been coined for this.

The third mistake would be to completely dispense with the determination of the net asset value in view of difficulties 1. and 2. That would be like omitting the determination of the capitalised earnings value – just because it is difficult to forecast the future earnings of the company.

The right way is to obtain expert opinions and ask experts.

In the case of real estate, commission an expert specialised in commercial real estate for the valuation of developed and undeveloped land. We recommend – if you do not know any – the expert office Wagner und Partner from Hamburg.

We can help you specifically with the valuation of machinery and equipment with our expert opinions. Ultimately, it has been our bread and butter business for many decades to correctly determine the asset values of machinery, technical equipment and operating facilities.

There are also proven methods for valuing customer bases, brands, etc. that M&A advisors are familiar with.

However, you will not arrive at a meaningful company valuation with the net asset value method alone (unless the company is actually to be “broken up”). Ultimately, every company is more than its individual parts. The company’s added value – and thus its profit – comes precisely from the clever combination of assets and resources.

Asset value-oriented methods become more important the more the economic success of a company depends on its tangible assets – i.e. its machinery, real estate and vehicle fleets.

Hybrid forms

Hybrid forms have developed from the practice of valuing start-ups, as the conventional methods often do not do justice to the specific circumstances of start-ups. The challenge in start-up valuation is that often neither stable historical values nor profits – indeed often no profits at all – are available. On the other hand, however, high, dynamic growth potential is assumed, which is (or should be) achieved primarily with intangible assets.

For this purpose, so-called venture capital methods have been developed that combine the DCF method with market value methods.

II. Which insights can be gained specifically from the net asset value?

A company valuation that includes all three components – earnings, market and substance – has the greatest informative value.

Both the business valuation and the subsequent or parallel due diligence are intended to identify risks, which are then negotiated into the terms of the transaction. By applying all three procedures and analysing them, you have the best chance of identifying all relevant risks.

Comparison of net present value and net asset value

In outlining the net asset value method, we noted that a company is more than the sum of its individual parts. Rather, it is important to combine the individual parts (i.e. all resources and assets) in such a way that added value – i.e. profit – is generated. This consideration is taken into account with the determination of capitalised earnings or capital values.

However, it also follows from this consideration that the capitalised earnings value is normally higher than the net asset value.

Therefore, the net asset value usually represents a lower price limit for a seller – the least he would accept. In tax law, too, the net asset value is in many cases the lowest valuation limit.

If the break-up or discontinuation of the company is considered, the liquidation value must be determined in order to know the upper and lower price limits.

It becomes interesting when the net asset value exceeds the capitalised earnings value. Here it is worthwhile to look closely at what the causes are.

- The company could simply be unprofitable – the invested capital generates too little profit. No added value is being generated.

- It may be that profits are not expected to accrue after the handover. Perhaps because there is a high dependency on the current business owner or because the customer base does not follow. In this case, the business would not be suitable for transfer, or only to a limited extent.

- Especially in the case of smaller companies, however, the real estate property could simply be disproportionately important – so that the net asset value is correspondingly high.

- However, it can also be an indication that the company has assets that are not necessary for the business (i.e. assets that are not actually needed in the business).

If the capitalised earnings value is considerably higher than the net asset value, this could be an indication of a gap in the market that may soon attract competition. It is possible that the competitive analysis should be intensified.

Determining asset values and technical due diligence

In order to determine the net asset value, it is first necessary to identify all assets. This means that a kind of inventory is carried out. This already shows whether inventories were carried out in the past and, if so, with what care.

The recording and assessment of the technical condition of the machines, vehicles and real estate can then already be considered part of the technical (as well as the financial due diligence) because it provides answers to questions about future repair costs, replacement investments and maintenance expenses.

At this point, it is important to note once again that asset accounting and the actual fixed assets usually have as little in common with each other as tax depreciation has with actual economic wear and tear. An independent recording of the assets – i.e. an inventory – is absolutely necessary.

Determination of asset value and insurance due diligence

In connection with the complete recording and valuation of the fixed assets at market or fair market values, an experienced valuer will also show you the new values of the fixed assets. This enables you to check insurance sums and coverage concepts within the framework of insurance due diligence and to identify gaps in coverage – i.e. risks. This aspect also plays a role in the financial due diligence, because you may have to reckon with higher or lower insurance premiums.

Determination of asset value and tax due diligence (asset deal)

Particularly in the case of so-called asset deals, the asset valuation of machinery plays a central role in the context of tax due diligence.

An “asset deal” is a transaction in which individual assets are acquired. The machines, licences, real estate – i.e. the assets – are transferred individually to the buyer. The counterpart is the share deal, in which company shares – for example shares or GmbH shares – are transferred.

In an asset deal, the assets – i.e. our machines, buildings, land – are revalued at their current market values and an addition is made to the original book values. This results in a – often significantly increased – depreciation potential.

Determination of asset value and financial due diligence

Financial DD is usually something like a big curved bracket: all analyses and checks within the individual due diligence components usually lead to consequences at the payment level. We have given examples of this from technical and insurance due diligence.

In addition, the determination of the liquidation value of the assets – i.e. the value of the assets in the event of the liquidation of the company – is important for the financial due diligence. This makes it possible to check whether the liquidation of the company would yield higher proceeds than the continuation of the company.

Eligibility as collateral and refinancing

The net asset values can also be used within the framework of financial due diligence to make statements about the loanability and refinancing capability of the individual assets and assets. The basis is then the determination of the market values or fair market values of the individual assets, i.e. the theoretical sale of the machinery, equipment, real estate, etc. if the business were to continue. This can be an important factor for the possible refinancing of the business acquisition.

III. Conclusion: The role of substance values in business valuation and due diligence

You will derive the greatest benefit from a business valuation that takes into account market-oriented, capital- and earnings-oriented as well as substance-oriented procedures and relates them to each other in a meaningful way.

The substance values also provide you with valuable insights within the due diligence process.

Just as it is worth the effort to forecast future earnings accurately (instead of simply extrapolating the past), it is worthwhile to determine the asset value directly and correctly (instead of simply extrapolating the balance sheet values). There are experts and valuers for this – like us, for example. (Contact)